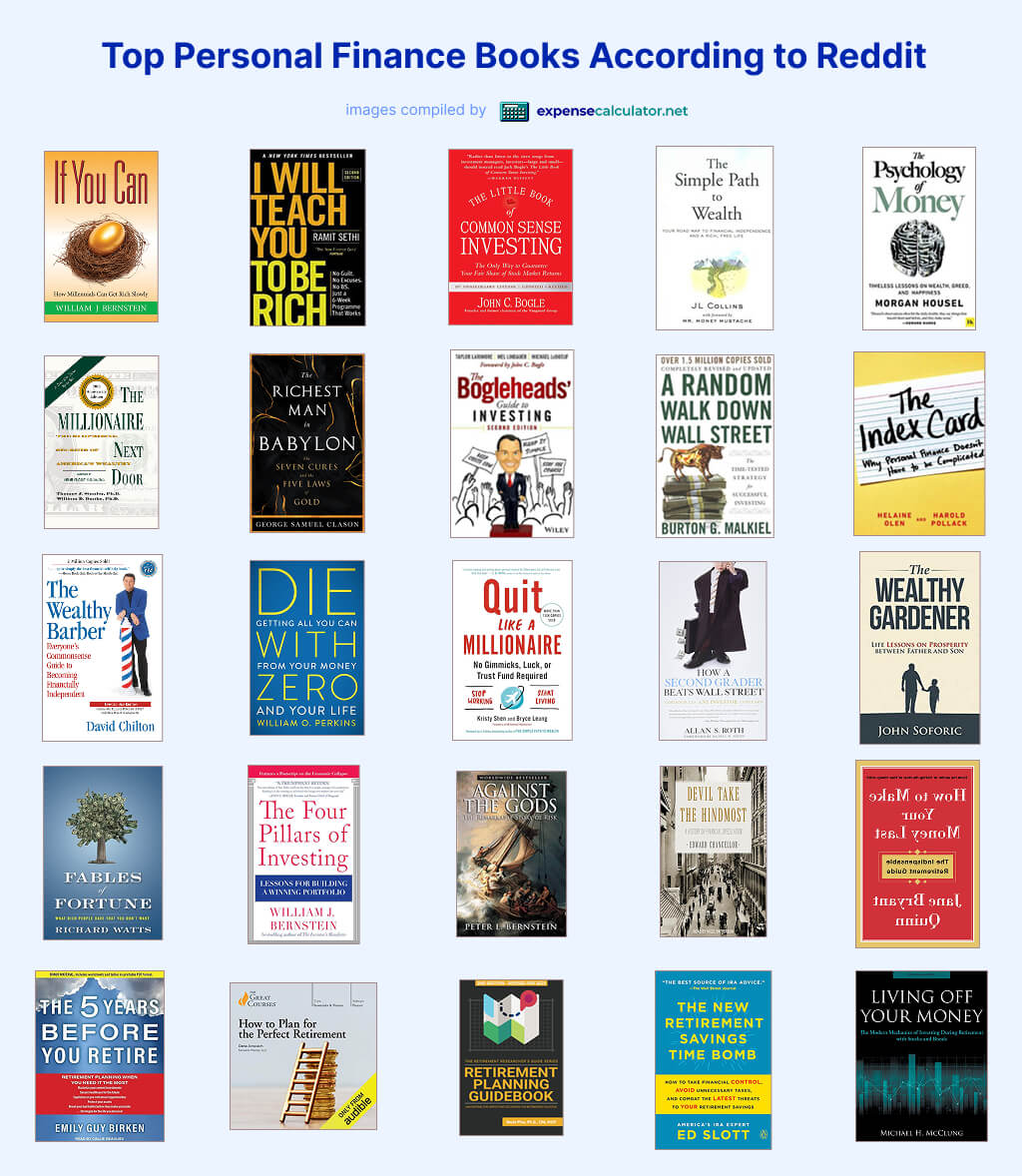

Top Personal Finance Books According to Reddit

After months of failed budgeting attempts and a growing frustration with bite-sized TikTok financial tips that never seemed to stick, I turned to Reddit for more substantial guidance.

Super excited to have discovered a treasure trove of book recommendations from people who had actually transformed their financial lives through reading (source). These weren't just any books—they were the tried and tested favorites of thousands of Redditors who had walked the path to financial literacy before me.

Honestly, I am still working my way through the recommendation (as well as my expense tracking habit - thus why I build this expense calculator), but I can already feel a shift in my understanding of money management; mostly deepened in ways that short-form content never provided. So I've compiled this list to share the wisdom that helped me break my cycle of financial frustration. Here are the top personal finance books according to Reddit, offering in-depth wisdom on investing, saving, and building sustainable wealth.

1. If You Can: How Millennials Can Get Rich Slowly

This concise 15-page PDF by William Bernstein packs powerful financial advice specifically targeted at millennials. When I first opened it, I was skeptical that anything so short could be meaningful, but I was wrong. Bernstein offers a straightforward approach to building wealth gradually that finally made sense to my debt-burdened millennial brain.

2. I Will Teach You To Be Rich

Ramit Sethi's practical guide was the first book that didn't make me feel guilty about my daily coffee habit. His six-week program focuses on automation and the psychological aspects of money management, covering everything from banking to mindful spending with a refreshing, no-nonsense approach that made me feel empowered rather than deprived.

3. The Little Book of Common Sense Investing

Written by Vanguard founder John "Jack" Bogle, this book completely changed how I viewed investing. Before reading it, I thought beating the market was the goal. Bogle convincingly explains why this is a losing game for most of us and offers a simpler, more effective approach to building wealth through low-cost index funds.

4. The Simple Path To Wealth

JL Collins' book feels like getting financial advice from a wise uncle. Originally written as letters to his daughter, this book demystified investing for me and provided clear, actionable advice for achieving financial freedom that I could actually implement without an economics degree.

5. The Psychology of Money

Morgan Housel's recent bestseller was a revelation for me. Through engaging stories, he explores how our emotions and psychology impact our financial decisions. This book helped me understand that successful money management has more to do with behavior and temperament than complex financial theories—a perspective that has helped me break numerous bad money habits.

6. The Millionaire Next Door

Thomas Stanley's eye-opening research completely changed my image of wealth. It turns out most millionaires live frugally rather than flamboyantly—driving used cars and living in modest homes. This book challenged my assumptions about wealth and showed me how ordinary people can build substantial net worth through disciplined saving and modest living.

7. The Richest Man in Babylon

When I was struggling to grasp basic financial principles, George Clason's classic parables set in ancient Babylon finally made them stick. The storytelling approach helped me internalize timeless concepts like "pay yourself first" and "live below your means" in a way that traditional finance books never could.

8. The Bogleheads' Guide To Investing

After getting hooked on Bogle's philosophy, this comprehensive guide by Mel Lindauer, Taylor Larimore, and Michael LeBoeuf deepened my understanding. The book's friendly, accessible tone made even complex investing principles feel manageable, while reinforcing the benefits of low-cost, diversified portfolios.

9. A Random Walk Down Wall Street

Burton Malkiel's classic work answered many of my "but what about..." questions regarding active investing. His thorough explanation of why markets are efficient and unpredictable strengthened my resolve to stick with passive investing, despite the constant temptation of the latest hot stock tips from friends.

10. The Index Card

I love simplicity, which is why Helaine Olen and Harold Pollack's approach was so refreshing. They distill personal finance wisdom into advice that literally fits on a single index card. This minimalist approach cut through my financial anxiety and gave me straightforward rules that I could actually remember and follow.

11. The Wealthy Barber

David Chilton's Canadian classic uses the story of a small-town barber to illustrate basic financial planning concepts. The conversational style made complex ideas accessible, and I found myself actually enjoying the financial education through its narrative approach.

12. Die with Zero

Bill Perkins' thought-provoking book challenged my inclination to save everything for "someday." His argument for optimizing life experiences rather than maximizing wealth accumulation helped me develop a more balanced approach to money—one that values memories and experiences alongside future security.

13. Quit Like A Millionaire

Kristy Shen and Bryce Laung's journey to financial independence spoke directly to my situation as someone without a huge income. Their math-focused guide combines personal narrative with practical strategies that showed me financial freedom is possible regardless of your salary, if you're strategic and consistent.

14. How A Second Grader Beats Wall Street

Allan Roth's entertaining book uses the perspective of his young son to illustrate a powerful point: effective investing doesn't need to be complicated. This book was a confidence booster that convinced me basic principles consistently applied yield better results than complex strategies I couldn't maintain.

15. The Wealthy Gardener

John Soforic's modern parable about a wealthy gardener and his son offered me both practical financial advice and philosophical insights about the true nature of wealth. This book helped me connect money management to my personal values in a way that purely technical guides couldn't achieve.

16. Fables of Fortune

Richard Watts' examination of the often-overlooked downsides of extreme wealth provided a refreshing perspective. Drawing from his experience working with wealthy families, Watts helped me develop a more nuanced view of financial success that considers personal fulfillment alongside net worth.

17. The Four Pillars of Investing

William Bernstein's comprehensive framework covering theory, history, psychology, and business gave me a well-rounded understanding of investing. His explanations helped me see market behavior in context and develop rational, evidence-based strategies rather than making emotional decisions.

18. Against The Gods

Peter Bernstein's fascinating examination of risk management and probability theory through history isn't a traditional finance book, but it profoundly changed how I think about uncertainty and risk in my financial planning. This intellectual history provides valuable perspective on modern investing approaches.

19. Devil Take The Hindmost

Edward Chancellor's history of financial speculation and market manias was both entertaining and educational. By examining historical bubbles and crashes, I gained perspective on market psychology and recognized recurring patterns that helped me avoid getting caught up in investment fads.

20. How To Make Your Money Last

While retirement seemed distant to me, Jane Bryant Quinn's essential guidance for turning savings into reliable income helped me think more concretely about my long-term goals. Her practical strategies for Social Security, pensions, and investment withdrawals gave me a clearer picture of what I'm saving for.

21. The Five Years Before You Retire

Emily Guy Birken's practical guide may seem premature for younger readers, but it helped me understand the critical pre-retirement phase my parents were entering, allowing me to have more meaningful financial conversations with them about healthcare options and lifestyle considerations.

22. How To Plan for the Perfect Retirement

Dana Anspach's Great Courses offering delivers a comprehensive retirement planning framework that helped me see retirement planning as an integrated process rather than just a savings target. This forward-looking perspective has improved my current financial decisions.

23. Retirement Planning Guidebook

Wade Pfau's detailed guide covers technical aspects of retirement income planning that I hadn't previously considered. Though advanced, his explanations of tax-efficient withdrawal strategies and portfolio sustainability gave me important concepts to grow into as my financial journey progresses.

24. The New Retirement Savings Time Bomb

Ed Slott opened my eyes to the complex tax rules surrounding retirement accounts. His strategies for minimizing tax burdens made me appreciate the importance of tax planning alongside investment growth—something I now incorporate into my financial decisions.

25. Living Off Your Money

Michael McClung's technically sophisticated book on withdrawal strategies for retirees initially seemed beyond my needs. However, understanding how to optimize retirement income while balancing market and longevity risks has shaped how I approach my own retirement accounts from the beginning.

Conclusion

I believe the most valuable lesson wasn't about specific investment strategies or savings rates, but rather the mindset shift that comes from truly understanding how money works. This is unfortunately something bite sized advice from TikTok or Instagram isn't able to offer.

Whether you're drowning in student loans like I was, trying to figure out how to start investing, or planning for retirement, I strongly suggest anyone to start with one book - just pick one that speaks to your current situation, and let your curiosity guide you from there.

Financial literacy isn't a destination but a journey—and these Reddit-approved recommendations are the most reliable maps I've found. Your future self will thank you for taking the first step.